It's that time of year when companies are in the middle of budgeting and forecasting. One of the questions I get asked a lot is 'how do I predict cash flow?'

Recently I had my father, Jim Boatsman, a retired accounting professor, teach a two day seminar to all of our staff on analyzing financial statements, forecasting, and valuing a business. It was a great course, and we all learned some valuable techniques – one of which I'll talk about here – forecasting cash flow using a very simple method.

First, some basic 'truths' you have to consider when forecasting your cash flow:

- Cash flow is derived ultimately from net income from the business. While as business owners we all like to think we can dramatically improve profitability in the short term in fact the data suggests that, barring major changes in the economy, it is actually very difficult to make dramatic improvements to overall profit margins. Limited exceptions might be short term instances where a company is significantly under capacity (e.g. manufacturing).

- Sales growth is often over estimated – unless you believe you have a great and proven pipeline of signed contracts (or a great sales process – see earlier post from Keith Eades seminar) – it's best to use historical growth rates or estimated growth rates for your industry.

- Generally when a company grows its operating assets (e.g. furniture, equipment, accounts receivable) it grows proportional to sales. That's because, similar to profit margin changes, changing the speed or ratio at which you turn over your assets (sales / assets) is also very difficult to impact in a short period of time.

So – given this, how do you forecast your cash flow for next year? Simple:

Cash Surplus / Deficit from One Year Operations:

Net Income MINUS

Change in Operating Assets MINUS

Change in Debt MINUS

Change in Equity

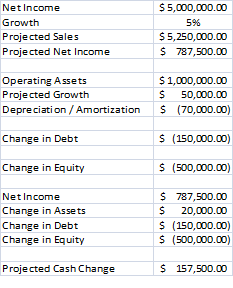

The formulas for each are as follows:

- Net Income = Projected Sales * historic net profit margin

- Change in Operating Assets = Sales Growth Rate * Assets – Depreciation / Amortization

- Change in Debt = planned principal payments of debt

- Change in Equity = either planned owner contributions or distributions (e.g. distributions, individual tax payments).

If, as a result of the formula, you see a significant increase or decrease in cash, it's a leading indicator that you should revisit your assumptions, as again it is often difficult to make dramatic improvements one way or the other.

As an example, assume a company has $1m in assets, profit margin of 15%, sales of $5m, and planned growth of 5%, and principle payments on debt total $150k. The owner typically distributes our $500k for personal living and tax payments.

In this case, the company expects to increase its cash by $157k, which makes sense since, fundamentally, the company doesn't take out more than its income or growth in assets each year.

If, however, sales were $3.5m with the same set of facts you would find that the company would have a projected cash short fall.

Hope this post helps as you go into budgeting season!