Unless you are a serial entrepreneur, you are only going to exit your business once. Make sure you do it right – at a financially secure value that preserves your legacy.

We work exclusively with business owners, which means we’ve seen our fair share of exits—both the wins and the wipeouts. And here’s what we know: when owners follow this simple approach, their exit almost always meets (or exceeds) expectations.

TRIPLE the value of your business by avoiding the 7 Deadly Sins that kill business value.

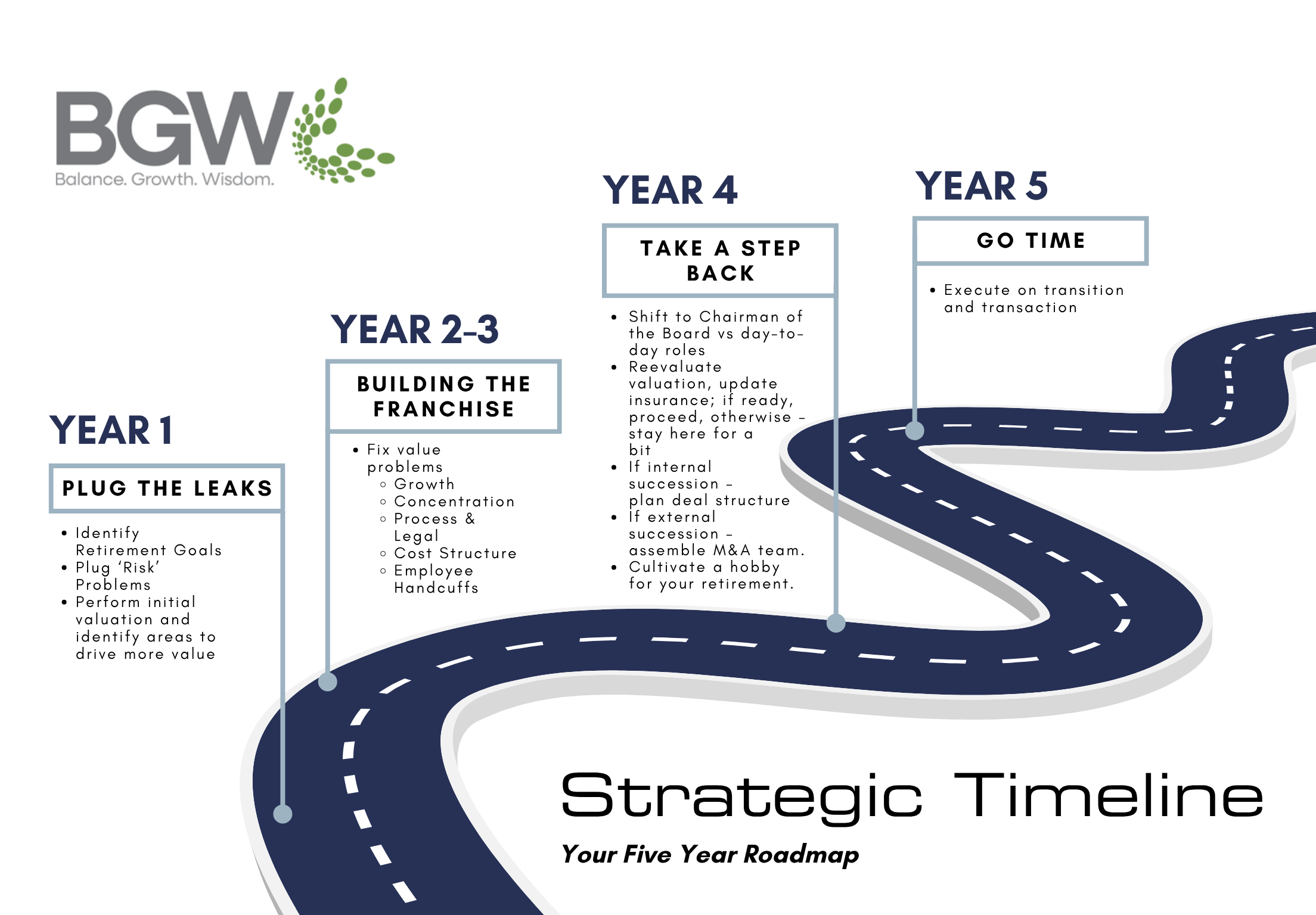

Our recommended 5-year transition plan isn't for the actual sale. It's preparing you for it. Get it now.

If you answered YES to 3 or more of Questions 1–5, you may be overdue to start planning your exit or succession—while you still have options.

If you answered YES to 3 or more of Questions 6–10, you’re probably feeling the pressure of unplanned succession, and now is the time to take control. Contact us.

Is your current accounting firm just “okay?”

It doesn’t have to be this way.

We have a pretty great podcast & insights that dig into issues you really care about.

Our passion lies in partnering with growth-oriented, private, closely held businesses that are frustrated by being stagnant and are ready for lasting change in their businesses and their lives.

BGW is the brand name under which BGW Advisors, LLC provide professional services. BGW Advisors, LLC practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations and professional standards. BGW Advisors, LLC and its subsidiary entities, which are not licensed CPA firms, provide tax, advisory, and other non-attest services to its clients. The entities falling under the BGW brand are independently owned and are not liable for the services provided by any other entity providing the services under the BGW brand. Our use of the terms "our firm" and "we" and "us" and terms of similar import, denote the alternative practice structure conducted by BGW Advisors, LLC.