The Best Places to Retire

Published on October 24, 2017

As I was scrolling through social media the other day, I saw an article on the “Best Places to Retire” in 2017. I see these kinds of articles a lot. Whether it’s Money Magazine or Forbes or someone else, media outlets love to produce these “best” lists -- for retirement, for starting a business, for buying your first home, you name it. I like these articles because they open my eyes to places I don’t naturally consider, like New Hampshire, which Bankrate actually named as the best place to retire. New Hampshire. With all the snow. Go figure. But fun as they are, these articles are too simple. Any good advisor will tell you that something as complicated as retirement requires a great deal of consideration and planning. A quick list just doesn’t cut it.

We field a lot of questions about retirement, and specifically taxes during retirement. Clients often want to know if crossing state lines to the more “tax-friendly” state will benefit them. And the answer we give is often a frustrating, “It depends.” There’s no quick answer to that question! What’s “tax-friendly” for one client may not be for another. That’s because different sources of retirement income -- Social Security, earned income, earnings from a defined benefit pension plan, income from assets in IRAs, and so on -- are taxed differently in every state. How you’ll be earning income (that is, in what form your checks will come) will greatly affect our advice. In addition, state and local sales and property taxes will also factor into our advice. Again, this is not a quick decision.

To give you an idea of how we come to a decision on where to move, or if you’d like to start planning on your own, consider the following:

Sources of income

What percentage of your income will come from Social Security, assets, and pension? This is the biggest question to answer because you can open up to (and eliminate) a lot of states this way. Some states exempt all pension income or all Social Security income while other states provide only partial exemption or credits. Some states offer no retirement breaks at all and tax all retirement income. Figure out first how you’ll be earning money, and then move forward examining how that income will be treated in each state.

If you plan on working in retirement and having that be your greatest source of income, a state that doesn’t tax individual income could be your best bet. Currently, Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not tax individual income.

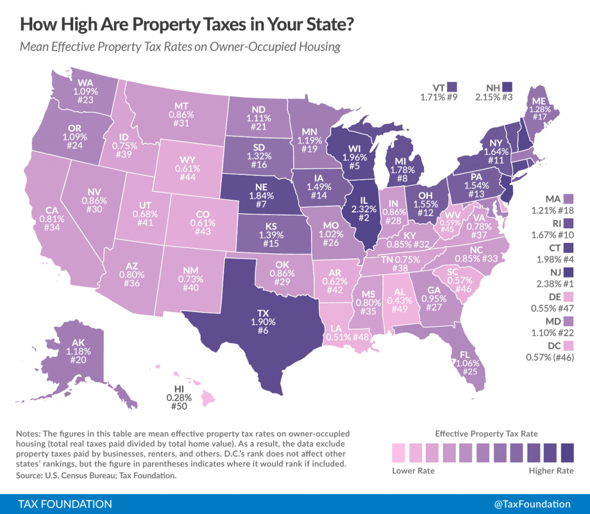

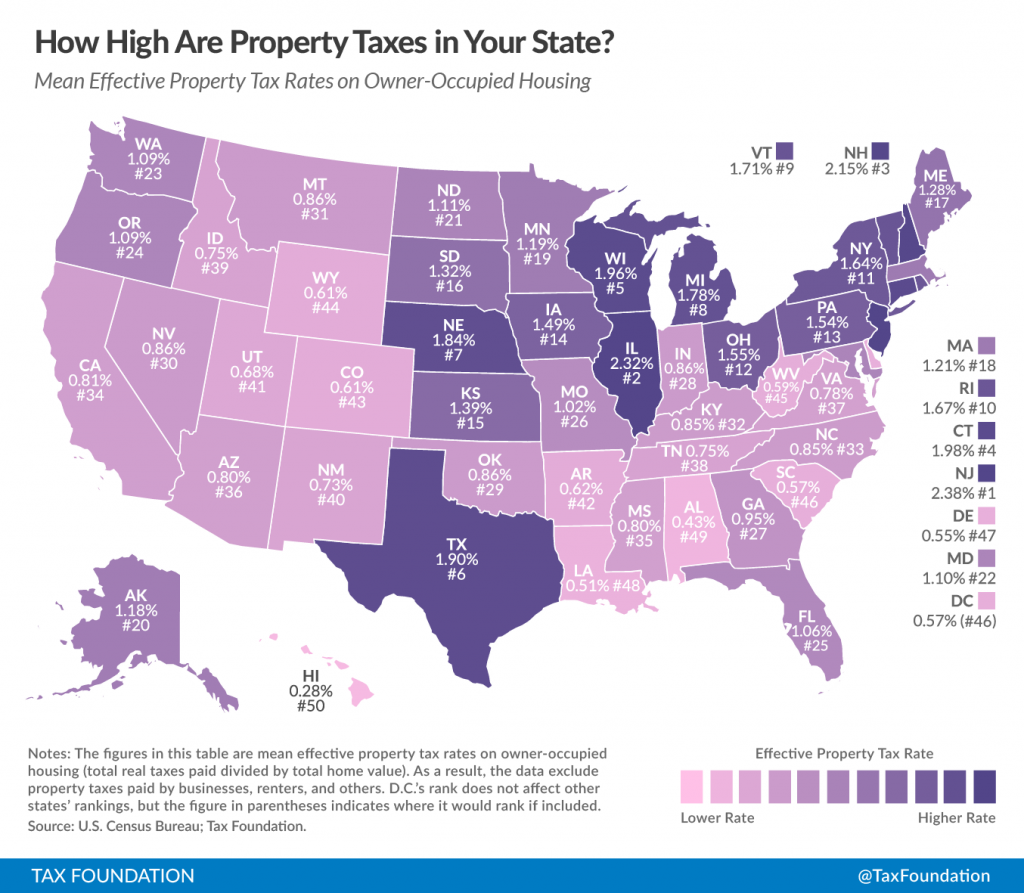

Property Taxes

Property taxes in other states can be jaw-dropping. Be sure you know what you’re getting into based on the kind of home you plan to own there. For some people, the amount they pay in property taxes will offset the savings they have to pay on income. Don’t make the mistake of moving for nothing.

Many states and some cities offer senior citizen homeowners some form of property tax exemption, credit, abatement, tax, deferral, refund, other benefits. South Carolina, for example, offers homeowners at age 65 an exemption on the first $50,000 on the value of their legal residence once they apply for the Homestead Exemption at their local county auditor’s office. And property taxes for homeowners are generally low in South Carolina, as legal residences are exempt from the property tax that funds public school operations.

Here is a great graphic from the Tax Foundation on property tax rates nationwide:

Overall Tax Burden

Plan on spending a lot in retirement? Then local and state sales taxes may be an issue for you. Grocery taxes, vehicle taxes, luxury taxes on boats and RVs...they all add up. When making your decision, also consider how you will live and what taxes might creep up on you.

Feeling overwhelmed now? BGW is here to help. One of the most beneficial things we do for clients is coming up with individual assessments for them based on the states they’re considering for retirement. We’d be happy to do the same for you. Of course, we’ll also encourage you to think about the kind of life you want to live in retirement. Saving tax money is good, but if it snows 6 months a year, will you really be happy? Perhaps. But your quality of life matters to us, too. We’ll be sure to ask you about it.

Happy planning!

Where are your retirement dreams currently taking you? We’d love to know in the comments below!