Construction, Contractor Guide to Revenue Recognition

Published on January 16, 2019

BGW is a premier construction CPA firm in Charlotte. Our view from SouthEnd reminds us daily just how much our construction and engineering partners are advancing our city.

BGW is a premier construction CPA firm in Charlotte. Our view from SouthEnd reminds us daily just how much our construction and engineering partners are advancing our city.

Since 2016, we’ve written with frequency on the changes coming to all industries due to the new revenue recognition standard. The changes, a result of ASC 606, replace substantially all current industry-specific norms of accounting for revenue with a principles-based common standard. And, that’s where things get tricky. For those in the construction and engineering industries, the waters can get very murky.

Some considerations that may result in significant changes to the current method of revenue recognition specific to construction and engineering contracts include:

- Contract modifications / change-orders

- Liquidated damage clauses or award/incentive payments

- Assessing the transfer of control in applying the percentage-of-completion method

- Uninstalled materials included as a measure of percentage-of-completion

- Maintenance service arrangements included with installation/construction contracts

As a Charlotte-based firm steeped in construction accounting, we could not ignore the impact this will have on our clients in these industries.

Introduction

The new revenue recognition standard applies to all contracts with customers -- parties that have contracted with an entity to obtain goods or services that are an output of the entity's ordinary activities in exchange for consideration (payment). This definition includes sales of fixed assets and intangible assets.

Note that the new guidance does not apply to lease and insurance contracts, financial instruments, guarantees, and certain nonmonetary exchanges. For information on changes to lease accounting, see our blog here.

The effective date for public companies was years beginning after December 15, 2017. For private companies, it’s December 15, 2018.

Adopting the New Guidance

You have two options for adopting the new guidance: 1) the Full Retrospective Method (cumulative effect adjustment to retained earnings in the earliest period presented), or 2) the Simplified Approach (modified retrospective application with a cumulative effect adjustment to retained earnings in the year of adoption).

In the first scenario, the company restates all periods presented as if they had been accounted for under ASC Topic 606 originally; comparative periods would be restated.

In the second approach, the company applies the new guidance to contracts that are ongoing as of the effective date and new contracts going forward. The cumulative adjustment to the opening balance sheet is reflected in retained earnings; disclosures in the financial statements must explain differences in each financial statement line item between ASC 606 and the method used prior to adoption. Comparative periods do not require restatement.

How do you decide which is the better approach? Look at your contracts. The simplified approach is recommended for those businesses that realistically forecast many changes in revenue recognition. Many large companies will likely utilize the full retrospective method that will require entities to restate comparative prior periods presented in current financial statements. Meanwhile, privately held construction entities may opt for the modified retrospective method instead and disclose the difference between the prior period (old method) and the current period (new guidance).

5 Step Process

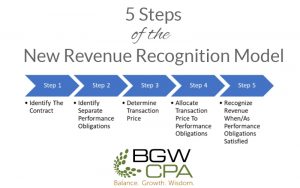

If you’re confused about the new guidance, you’re not alone. The new guidance is tricky thanks to a principles-based approach that requires the application of a 5 step process (below) to make a final determination on how revenue is recognized. This leads to a lot of questions and opportunities for judgment calls. That’s why we’re we so adamant about getting an early start with professional accounting help.

The new guidance intends for companies to recognize revenue in an amount that depicts “the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services." The five-step process pictured above and detailed below will help all companies apply this principle. We have also included some specific considerations for construction companies and engineering firms.

STEP 1: IDENTIFY THE CONTRACT

This may seem straightforward, however, the new guidance is more restrictive in regards to combining and segmenting contracts. In the construction industry, this can become complicated because there are typically multiple contractual arrangements with various parties or suppliers and the ultimate end customer. You will need to carefully assess parties to the contracts and the new criteria to determine if certain contracts are required to be combined which would impact the percentage-of-completion and timing of revenue recognition.

Contract modification or change orders which are common in the construction industry are also specifically addressed in the new standard. These must be evaluated to determine whether to treat as part of an existing contract or a separate contract. How change orders are classified (e.g. separate contract or modification to existing contract) will determine the accounting. If the additional goods or services are distinct (see Step 2 Identify The Performance Obligation), then would be either an increase to the contract price or a prospective adjustment, if not distinct, then the modification is treated as a cumulative catch-up adjustment to retained earnings. Typically, unpriced change order does not meet the criteria to be accounted for as a separate contract. Instead, unpriced change orders must be estimated and are considered variable consideration (refer to step 3 Determine The Transaction Price).

Question to consider:

- Are multiple contracts negotiated with a single commercial objective?

- Is the amount of consideration in one contract dependant on another contract?

STEP 2: IDENTIFY THE PERFORMANCE OBLIGATION

A performance obligation is a distinct good or service provided by a contract. If there are other promises in a contract that are different or can be distinguished from others, a more thorough analysis should be performed. Multiple performance obligations should be treated as separate contracts, even if they exist in one contract with the customer. However, given the high level of integration that is typically involved with construction and engineering contracts, many companies may conclude that there is only a single performance obligation. Situations unique to this industry that are addressed in the guidance include the following:

- Change orders are considered separate contracts if, 1) they increase scope to provide for additional promised goods or services to be delivered that are distinct (a separate performance obligation), and 2) the increase in contract value reflects the contractor’s estimated additional costs.

- Series contracts (for example, a contract to replace a roof for a group of buildings) may be treated as one performance obligation given that the services provided are substantially the same. If the buildings have different circumstances (for example, scope, access, mobilization), the performance obligations must be separated.

- Assurance warranties will typically be included with the original contract. Service warranties (for example, installation plus quarterly check-ups) may need to be separated into performance obligations.

Questions to consider:

- Do our contracts include multiple, distinct promises of goods or services? Are there separate performance obligations?

- Do our contracts include service warranties, and should those be treated as separate contracts?

- Do we have a process to review change orders to ensure that we are accounting for them correctly?

- If we have multiple performance obligations, do we have the proper procedures in place to track the costs and revenues separately? Does our accounting system have the ability to track them?

STEP 3: DETERMINE THE TRANSACTION PRICE

Typically, contract prices are stated in the contract and are straightforward. However, should the contract include variable consideration (performance bonuses, safety bonuses, liquidated damages, unapproved/unpriced change orders), contractors will need to estimate the amount of variable consideration to include in the contract value when known and probable to occur.

Question to consider: Do our contracts include any variable consideration clauses, and what are the probabilities that these will be earned/lost?

STEP 4: ALLOCATE THE TRANSACTION PRICE

Should only one performance obligation be identified in step two above, step four should not be complicated. However, if multiple performance obligations were identified, the most reasonable allocation method will be to allocate the contract price based on how the contract was bid.

Question to consider: Do we have multiple performance obligations?

STEP 5: RECOGNIZE THE REVENUE

Current US GAAP provides for either the percentage-of-completion or completed contract method of recognizing revenue for long-term contracts. Similarly, the new standard utilizes specific criteria to assess whether a transfer of control occurs over time or at a point of time to determine the method of recognizing revenue. The difference is under current US GAAP companies have the option for either method. Under the new standard, it is based on the timing of the transfer of control.

To be recognized over time based on a percentage-of-completion method at least ONE of the following must be met:

- The customer receives and consumes the benefits of the contract as the performance occurs (e.g. maintenance service arrangement)

- The performance of the contract creates or enhances a customer-controlled asset (e.g. construction of an asset on customer’s site)

- The performance does not create an asset with an alternative use to company AND the company has an enforceable right to payment for work done to date.

Question to consider: When is the transfer of control happening? Have we met the criteria to use percentage-of-completion?

OTHER CONSIDERATIONS

- Under the new standard, certain costs that are recoverable should be capitalized and expensed over the life of the contract, if the contract is expected to exceed one year. Costs include incremental costs of obtaining a contract, such as sales commissions, bond premiums, and mobilization costs.

- Uninstalled materials should be excluded when measuring progress on a contract. For example, a building contract which includes a significant elevator installation. If the elevators are ordered and delivered to a job site, but not installed at year end, this cost must be excluded when determining the percent complete on other aspects of a job.

- Significant inefficiencies will be excluded from the complete calculation of a contract.

- Retention will be classified as costs in excess of billings rather than under accounts receivable.

- The IRS has not indicated that they will follow the new standard at this moment. This may result in book-tax differences.

- When adopted, differences in current GAAP and this standard for contracts in progress at adoption will be posted directly to equity, which may result in revenue never being recognized or double counted.

STEPS TO TAKE NOW:

- Read and inventory your contracts. Pay special attention to different performance obligations or variable consideration arrangements.

- Ensure that procedures exist and the accounting system is capable of tracking costs separately should multiple performance obligations exist.

- Ensure that sales staff and other individuals authorized to enter into contracts are educated on the new standard.

- Ensure that procedures exist to identify multiple performance obligations before work begins so that costs can be tracked separately.

Conclusion

At the very least, the new standard will introduce judgment and subjectivity, and in turn, financial reporting risk. You need start evaluating the implications now and preparing for the changes. This is difficult work. We strongly recommend you reach out to your BGW team member right away to discuss how to begin navigating these issues. The deadline for compliance is fast approaching.