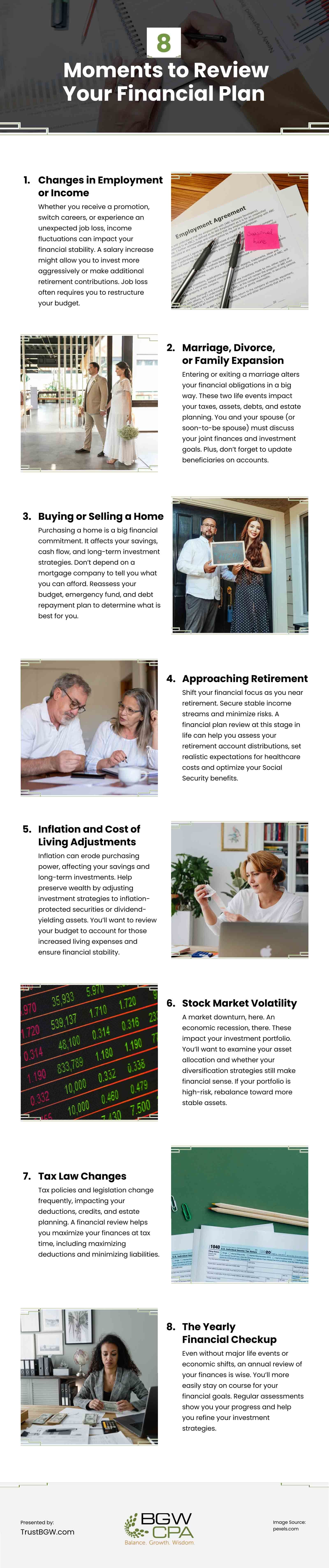

The Right Time to Review Your Financial Plan

Published on May 22, 2025

Financial planning and investment management isn’t a one-time task. It’s an ongoing process to align your financial goals with life’s changes.

A significant life event, investing in stocks and bonds, and retiring should trigger you to review your financial strategy. Not regularly revisiting your financial plan means missed opportunities to improve your savings, investments, and long-term security.

When should you review your financial plan? The answer depends on factors like your goals and the economy.

You work hard for your money and want to make smart financial moves. However, not reviewing your finances can lead to inefficiencies or outdated methods that no longer serve your needs.

So, when is the “right time” to review your financial plan? Discover the eight best times to reassess your finances and secure your future below.

Major Life Events Equal a Financial Plan Review

Revisit your financial plan when you have a significant life change. Big events (marriage, parenthood, homebuying, etc.) often adjust your financial situation, requiring you to reevaluate your investments, savings strategies, and overall financial goals.

1. Changes in Employment or Income

Whether you receive a promotion, switch careers, or experience an unexpected job loss, income fluctuations can impact your financial stability.

A salary increase might allow you to invest more aggressively or make additional retirement contributions. Job loss often requires you to restructure your budget. If you recently changed jobs, review benefits such as 401(k) plans, stock options, and employer-provided insurance to take advantage of opportunities and avoid financial gaps.

2. Marriage, Divorce, or Family Expansion

Entering or exiting a marriage alters your financial obligations in a big way. These two life events impact your taxes, assets, debts, and estate planning.

You and your spouse (or soon-to-be spouse) must discuss your joint finances and investment goals. Plus, don’t forget to update beneficiaries on accounts.

On the other hand, divorce requires dividing your assets, modifying estate plans, and calculating alimony or child support obligations.

Welcoming a child brings new expenses, too. It’s never too early or too late to plan for their education. And, of course, you’ll need additional insurance coverage and updated wills.

3. Buying or Selling a Home

Purchasing a home is a big financial commitment. It affects your savings, cash flow, and long-term investment strategies.

Don’t depend on a mortgage company to tell you what you can afford. Reassess your budget, emergency fund, and debt repayment plan to determine what is best for you.

Selling a home and transitioning to a new living situation requires just as much planning as homebuying. Even if you downsize in preparation for retirement, you still need to look at your overall financial picture to evaluate proceeds, determine how you should reinvest money, and assess capital gains taxes.

4. Approaching Retirement

Shift your financial focus as you near retirement. Secure stable income streams and minimize risks.

A financial plan review at this stage in life can help you:

- Assess your retirement account distributions

- Set realistic expectations for healthcare costs

- Determine what adjustments to make to your asset allocations

- Ensure your savings align with projected expenses

- Optimize your Social Security benefits

A financial planning and investment management service can help you create a sustainable post-retirement lifestyle.

Economic Changes and Market Conditions

We’ve discussed personal milestones. Let’s discuss external factors, such as economic shifts and market trends that should trigger a review of financial plans.

5. Inflation and Cost of Living Adjustments

Inflation can erode purchasing power, affecting your savings and long-term investments. Help preserve wealth by adjusting investment strategies to inflation-protected securities or dividend-yielding assets.

Your future cost of living is almost guaranteed to be higher than your current one. You’ll want to review your budget to account for those increased living expenses and ensure financial stability.

6. Stock Market Volatility

A market downturn, here. An economic recession, there. These impact your investment portfolio.

You’ll want to examine your asset allocation and whether your diversification strategies still make financial sense. If your portfolio is high-risk, rebalance toward more stable assets. Lower stock prices can help you invest more in safer stock options.

A Certified Public Accountant (CPA) can provide tailored advice on market-driven adjustments.

7. Tax Law Changes

Tax policies and legislation change frequently, impacting your deductions, credits, and estate planning. A financial review helps you maximize your finances at tax time, including maximizing deductions and minimizing liabilities.

As a business owner, you’ll want to stay informed about corporate tax adjustments. These can impact your cash flow and long-term profitability.

8. The Yearly Financial Checkup

Even without major life events or economic shifts, an annual review of your finances is wise. You’ll more easily stay on course for your financial goals. Regular assessments show you your progress and help you refine your investment strategies.

Investments

Markets fluctuate. What worked last year might not work well this year.

Evaluating the past year’s investment returns, risk exposure, and asset allocations helps you rebalance your portfolio. If investments underperform, you can improve your wealth and reduce risks by reallocating assets or diversifying holdings.

Insurance

Review your policies each year. Consider higher coverage amounts for life changes such as new dependents, homeownership, or increased income levels. Look into cost-effective insurance options or bundling policies to save money.

Estate Plans and Beneficiaries

Outdated estate plans can cause your heirs legal and financial complications. Review your wills, trusts, and designated beneficiaries so that your assets are distributed according to your wishes. Once again, big life changes require you to adjust these documents.

Savings and Debt Repayment Strategies

Financial goals change with time. Stay financially prepared by reassessing savings contributions, emergency funds, and debt repayment plans.

Explore refinancing options if you have any high-interest debt.

You may consider increasing retirement contributions if you’re nearing retirement or are financially independent.

How to Conduct a Financial Plan Review

Take a structured approach to your financial planning. Address major key areas with this simplified method:

- Gather financial statements. Collect account statements, investment records, and tax returns to analyze your current financial status.

- Assess your progress toward goals. Compare past goals with current achievements. Identifying areas for improvement.

- Evaluate your risk tolerance. Market conditions and personal circumstances may alter your risk tolerance. Allocate your investments accordingly.

- Consult a financial advisor. A professional financial advisor can help you optimize investment strategies and tax planning.

A yearly review can keep your financial decisions aligned with evolving circumstances.

Review Regularly

A well-structured financial plan is a living document—it evolves as your life and circumstances do. Review your plan at least once a year.

Changes in life, economic conditions, and investment performance all influence your financial stability. Review your financial picture after significant life changes to enjoy long-term wealth growth through major milestones and market fluctuations.

Maximize your savings, reduce risks, and adapt to changing financial landscapes with regular financial checkups.

To find a financial planning service in Charlotte, NC, look for a CPA firm with excellent reviews and ratings. Your firm should tailor solutions to your circumstances, helping you confidently navigate complex financial decisions.

FAQs

1. How often should I review my financial plan?

Review your financial plan at least once a year to align it with your financial goals. Additionally, if you experience a major life event, such as a job change, marriage, or the birth of a child, you should reassess your plan immediately. Regular check-ins help you optimize investments, adjust budgets, and ensure long-term financial stability.

2. What life events should trigger a financial plan review?

Major life events like getting married or divorced, having children, changing jobs, buying a home, or nearing retirement should prompt a financial plan review. These events often impact income, tax status, investment priorities, and estate planning. Reviewing your plan during these milestones ensures that your financial decisions reflect your new circumstances.

3. Why is financial planning important?

Financial planning helps you set, manage, and achieve financial goals by creating a roadmap for budgeting, investing, and saving. It helps allocate resources efficiently to prepare for unexpected expenses, secure retirement, and grow wealth. Without a solid plan, financial decisions may lack structure, increasing the risk of inefficiencies or future financial stress.

4. How do I know if my investment strategy needs to be adjusted?

If your investment returns are underperforming, your risk tolerance has changed, or economic conditions have shifted, it may be time to reassess your strategy. Portfolio imbalances, increased market volatility, or approaching retirement are also indicators that adjustments may be necessary. Regularly reviewing your asset allocation helps optimize risk and returns based on your financial goals.

5. What role does inflation play in financial planning?

Inflation erodes purchasing power over time, making it essential to incorporate strategies that protect wealth from its impact. This may include investing in inflation-protected securities, real estate, or dividend-paying stocks to preserve value. Without adjusting your financial plan for inflation, long-term savings may lose their effectiveness in covering future expenses.

6. Should I consult a financial advisor for my financial planning review?

A financial advisor can provide expert insights into tax-efficient investing, risk management, and long-term wealth growth. A professional can assess market conditions, suggest asset reallocation, and tailor strategies to your specific financial goals. If you lack the time or expertise to analyze your finances thoroughly, a financial planner can help you make informed decisions.

7. How does tax law affect my financial plan?

Changes in tax law can impact deductions, retirement contributions, estate planning, and investment returns. Reviewing your financial plan in response to tax changes helps you maximize savings while minimizing liabilities. Consulting a tax professional or financial planner ensures you’re taking advantage of updated tax benefits and strategies.

8. What are the key components of a financial plan?

A comprehensive financial plan includes budgeting, investing, retirement planning, risk management, tax planning, and estate planning. Each component aligns your income, expenses, savings, and long-term goals for financial security. Regularly reviewing and adjusting these elements ensures continued progress toward financial success.

9. How can I prepare for an annual financial plan review?

To prepare for a financial plan review, gather recent financial statements, tax returns, investment reports, and budget details. Evaluate changes in income, expenses, or debt levels and assess progress toward financial goals. If working with a financial advisor, having an organized overview of your financial situation allows for a more productive discussion.

10. What happens if I neglect to review my financial plan?

Neglecting financial plan reviews can lead to outdated investment strategies, missed tax-saving opportunities, and financial inefficiencies. Life and economic changes can alter your financial needs, and failing to adjust accordingly may result in missed growth potential or unexpected financial burdens. Review your plan regularly to keep it effective in securing your financial future.

Video

Infographic

Financial planning and investment management are continuous processes that must evolve with life changes and shifting goals. This infographic highlights key moments to reassess your financial plan.